A flexible solution that suits your needs

-

>

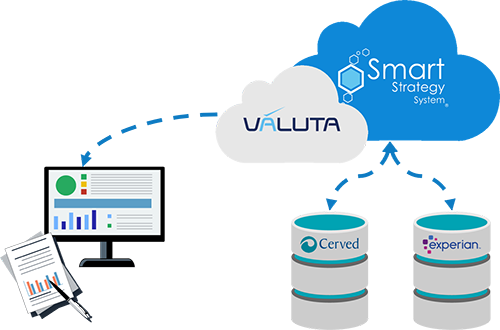

Custom Solution Valuta 2 Web

The Valuta 2 web platform, provided as Software As A Service, manages the origination process for Cerved Group customers.

Goals

Create a custom web interface to evaluate the risk profile of the loan request and the applicants, upload the supporting documentation and generate the risk evaluation reports.

The web interface is integrated with the decision engine Smart Strategy System which manages the evaluation process. Smart Gateway is used for automated data acquisition from Cerved and Experian information providers.

Results

The Cerved Group now has a scalable platform based on its needs, available anytime, anywhere thanks to the potential offered by the cloud. The maintenance of the decision making processes and summary reports produced by the system is quick and easy, ensuring rapid Time-to-Market.

-

>

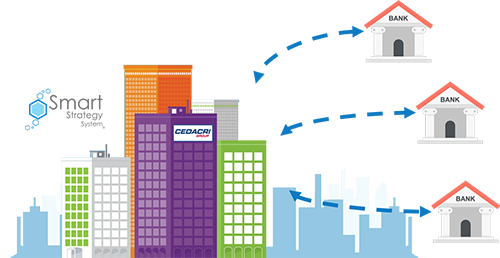

Smart Strategy System into the Cedacri PEF system

The decision engine was integrated into the Cedacri PEF (electronic credit line procedure) infrastructure to assist risk assessment in the credit origination phase.

Goals

To evaluate credit requests using data provided by the system, such as counterparty negative events, financial exposure, ratings from Cerved and Experian and BankItalia data.

The evaluation is proved through multiple steps of analysis, depending on the depth of investigation required by the Client Bank.

Result

The Cedacri PEF system is now integrated with a highly flexible and customizable credit evaluation system. The maintenance of decision-making processes integrated into the system is quick and easy, guaranteeing a very rapid Time-to-Market.

-

>

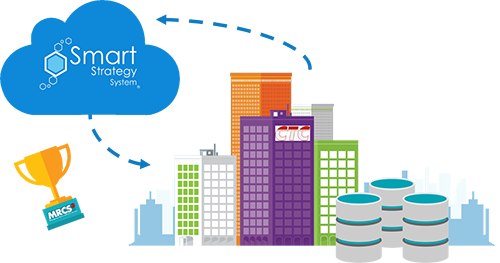

Statistical models management

The decision-making system used as a statistical model manager, in this case to evaluate the recovery rate of non performing loans (NPL).

Goals

We have provided to the CTC consortium the decision-making system to manage a behavioral indicator to be used throughout the lifecycle of the contract in order to evaluate its recoverability rate using an hystorical data set. The indicator allows to determine the management of collection activities according to the recoverability rate taking into account the cost-effectiveness parameters.

Result

The contracts were grouped into 10 homogenous recovery classes based on potential recovery rates and the descriptive characteristics of the contract/tax code. The first 5 classes represent 25% of the exposure in the information provider database and guarantees a recovery rate of 45% (6 times compared to the average), while the last 2 classes contain those cases deemed to be of zero recovery probability.